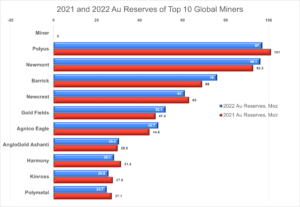

5 of the Top 10 largest mining companies saw a positive percenatge growth from 2021 to 2022. Gold Fields and Barrick registered 9% growth each from a difference of 4.7 Moz and 7 Moz of Au Reserves respectively. Harmony was the greatest loser among the Top 10, dropping down 12% from 3.3 Moz of Au from the previous year’s reserves.

Rusian gold mining giant Polyus boasts the largest gold reserves base globally. As at 31 December 2022, the company reported 97 million ounces of gold in reserves compared to 101 million ounces as at 31 December 2021. The company said the year-over-year decrease in gold reserves was due to depletion by mining and changes to stockpile inventories due to additions from mining and reclaim for processing.

Newmont has the second largest gold reserves base across the industry. For 2022, Newmont reported 96.1 million ounces of gold mineral reserves, a 3.6% increase from the prior year total of 92.8 million ounces. The company explained that additions of 8.6 million ounces and acquisitions of 3.1 million ounces were partially offset by depletion of 7.2 million ounces and unfavorable net revisions of 1.2 million ounces.

Barrick is third with 76 million ounces of gold reserves reported in 2022, an increase of 10% over 2021 (69 million ounces). The company said that its gold mineral reserves growth was led by Pueblo Viejo and the Africa & Middle East region, with nearly 12?million ounces of attributable proven and probable reserve gains in 2022 before depletion.

Newcrest sits fourth. The company reported 61 million ounces of gold reserves as at 30 June 2022, which is a 3% decrease compared to reserves as at 31 December 2021 (63 million ounces), primarily due to mining depletion.

Gold Fields is fifth with 52.1 million ounces of gold in reserves reported in 2022 compared to 47.4 million ounces in 2021.

Agnico Eagle sits sixth. The company’s proven and probable mineral reserves increased by 9% year-over-year to 48.7 million ounces of gold (1,186 million tonnes grading 1.28 grams per tonne gold). The company said the increase in mineral reserves was largely due to significant additions at Detour Lake as well as successful conversion of mineral resources at several other operations.

AngloGold Ashanti’s ore reserves increased from 29.8 million ounces in December 2021 to 30.4 million ounces in December 2022. This annual net increase of 0.6 million ounces includes additions due to exploration and modelling changes of 2.8 million ounces, and changes in economic assumptions of 1.0 million ounces. This increase was partially offset by depletion of 2.9 million ounces and reductions due to other factors of 0.3 million ounces.

Harmony Gold’s total attributable gold mineral reserves amounted to 28.1 million ounces at 30 June 2022, compared to 31.4 million ounces at 30 June 2021. The decrease was mainly due to the mineral reserves reduction at the Tshepong and Bambanani operations as a result of the reduction of the life-of-mine of the respective operations.

Kinross’ total estimated proven and probable gold reserves at December 31, 2022 were approximately 25.5 million ounces, a decrease of 2.1 million ounces from 27.6 million ounces (excluding 5.0 million ounces related to the Chirano and Russian operations) at December 31, 2021. The decrease in estimated gold reserves compared to December 31, 2021 was mainly a result of production depletion.

In 2022, Russian mining giant Polymetal’s gold reserves decreased by 9% year-on-year to 24.7 million ounces, mostly due to mining depletion. This was partially offset by the successful exploration results at Omolon hub (Burgali and Nevenrekan), Pesherny (Voro hub), as well as initial reserve estimates at Galka and Tamunier (Voro hub).